The Johnson Amendment is a provision in the U.S. tax code, since 1954, that prohibits all 501(c)(3) non-profit organizations from endorsing or opposing political candidates. Section 501(c)(3) organizations are the most common type of nonprofit organization in the United States, ranging from charitable foundations to universities and churches. The amendment is named for then-Senator Lyndon B. Johnson of Texas, who introduced it in a preliminary draft of the law in July 1954.

In the 2000s, many Republicans, including President Donald Trump, have sought to repeal the provision, arguing that it restricts the free speech rights of churches and other religious groups. These efforts have been criticized because churches have fewer reporting requirements than other non-profit organizations, and because it would effectively make political contributions tax-deductible. On May 4, 2017, President Donald Trump signed an executive order "to defend the freedom of religion and speech" for the purpose of easing the Johnson Amendment's restrictions.

Video Johnson Amendment

Provisions

Paragraph (3) of subsection (c) within section 501 of Title 26 (Internal Revenue Code) of the U.S. Code (U.S.C.) describes organizations which may be exempt from U.S. Federal income tax. 501(c)(3) is written as follows:

-

-

- (3) Corporations, and any community chest, fund, or foundation, organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, or educational purposes, or to foster national or international amateur sports competition (but only if no part of its activities involve the provision of athletic facilities or equipment), or for the prevention of cruelty to children or animals, no part of the net earnings of which inures to the benefit of any private shareholder or individual, no substantial part of the activities of which is carrying on propaganda, or otherwise attempting, to influence legislation (except as otherwise provided in subsection (h)), and which does not participate in, or intervene in (including the publishing or distributing of statements), any political campaign on behalf of (or in opposition to) any candidate for public office.

-

The Johnson amendment is the bolded portion of this provision beginning with the words "and which does not participate in, or intervene in [ . . . ]." The amendment affects nonprofit organizations with 501(c)(3) tax exemptions, which are subject to absolute prohibitions on engaging in political activities and risk loss of tax-exempt status if violated.

Specifically, they are prohibited from conducting political campaign activities to intervene in elections to public office. The Johnson Amendment applies to any 501(c)(3) organization, not just religious 501(c)(3) organizations.

The benefit of 501(c)(3) status is that, in addition to the organization itself being exempt from taxes, donors may also take a tax deduction for their contributions to the organization.

According to the Internal Revenue Service, contributions to political campaign funds, or public statements of position in favor of or in opposition to any candidate for public office, are disallowed. However, certain voter education activities as well as voter registration and get-out-the-vote drives, if conducted in a non-partisan manner, are not prohibited.

Maps Johnson Amendment

History

The amendment was to a bill in the 83rd Congress, H.R. 8300, which was enacted into law as the Internal Revenue Code of 1954. The amendment was proposed by Senator Lyndon B. Johnson of Texas on July 2, 1954. (Johnson would later serve as President from 1963 to 1969.) The amendment was agreed to without any discussion or debate and was included in Internal Revenue Code of 1954 (Aug. 16, 1954, ch. 736). The provision was considered uncontroversial at the time, and continued to be included when the 1954 Code was re-named as the Internal Revenue Code of 1986 during the Ronald Reagan administration.

Repeal efforts

In the 2010s, the Alliance Defending Freedom made attempts to challenge the Johnson Amendment through the Pulpit Freedom Initiative, which urges Protestant ministers to violate the statute in protest. The ADF contends that the amendment violates First Amendment rights.

During his 2016 presidential campaign, Donald Trump called for the repeal of the amendment. On February 2, 2017, President Trump vowed at the National Prayer Breakfast to "totally destroy" the Johnson Amendment, White House Press Secretary Sean Spicer announced to the press that the President "committed to get rid of the Johnson Amendment", "allowing our representatives of faith to speak freely and without retribution", and Republican lawmakers introduced legislation that would allow all 501(c)(3) organizations to support political candidates, as long as any associated spending was minimal.

On May 4, 2017, Trump signed the "Presidential Executive Order Promoting Free Speech and Religious Liberty." The executive order does not (nor can it) repeal the Johnson Amendment, nor does it allow preachers to endorse from the pulpit, but it does direct the Department of Treasury that "churches should not be found guilty of implied endorsements where secular organizations would not be." Douglas Laycock, speaking to The Washington Post, indicated that he was not aware of any cases where such implied endorsements have caused problems in the past. Walter B. Jones Jr. has been the principal congressional advocate for repealing the speech restriction altogether and has support from the Family Research Council in modifying religious speech language in the Kevin Brady sponsored tax re-write legislation styled, the Tax Cuts and Jobs Act of 2017.

Criticism of repeal efforts

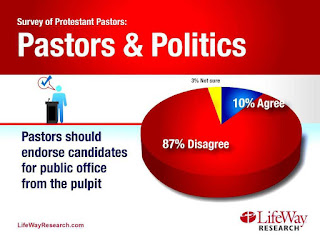

Efforts to repeal the Johnson Amendment have been criticized for a number of reasons. One concern is that political campaign contributions funneled through 501(c)(3) organizations would be tax-deductible for donors, and that such contributions would not be disclosed, since churches are exempt from reporting requirements required of other 501(c)(3) organizations. Under this critique, repeal would have the potential of creating a mechanism where political contributions could be made in violation of relevant campaign financing laws. Polls have shown that majorities of both the general public and of clergy oppose churches endorsing political candidates. The National Council of Nonprofits released a statement opposing the proposed repeal legislation. Independent Sector, a coalition of nonprofits, foundations, and corporations has also stated their opposition to the proposal to repeal the Johnson Amendment.

There has also been concerns from pastors and Christians about the potential that a total repeal would cause churches to transform into partisan super PAC's.

See also

- Separation of church and state in the United States

References

Further reading

- Caron, Wilfred R.; Dessingue, Deirdre (1985). "I.R.C. §501(c)(3): Practical and Constitutional Implications of Political Activity Restrictions". Journal of Law & Politics. 2 (1): 169-200.

- Davidson, James D. (1998). "Why Churches Cannot Endorse or Oppose Political Candidates". Review of Religious Research. 40 (1): 16-34. JSTOR 3512457.

Source of the article : Wikipedia